TL;DR

Smallhold, Boisson, and Foxtrot all recently filed for bankruptcy after raising lots of money and growing fast during ZIRP

Blank Street Coffee looks awfully similar and could face the same fate

Essentially free money led venture investors to throw money at these companies to fuel unnatural growth

But atoms don’t scale like bits. Atoms are physical objects that are subject to laws of chemistry and physics. Bits are limited only by the technology used to process and store them, not by immutable physical laws.

When the fire hose of money that allowed these companies to defy physical laws was shut off, they came crashing back to earth

This search did not yield any results. I was thinking it might come up as“companies that were flying high in the Zero Interest Rate Period (ZIRP) that then crashed and burned into bankruptcy in the last few months”. The flood of cash they relied upon from venture capital went away and the unit economics caught up with the businesses.

If you follow this stuff at all, you’re probably like, wait, Blank Street Coffee didn’t file for bankruptcy; why’s that in there? You’re right, they haven’t. But there’s a lot of similarities between Blank Street and the other companies and that’s whats leading me to suggest a similar fate.

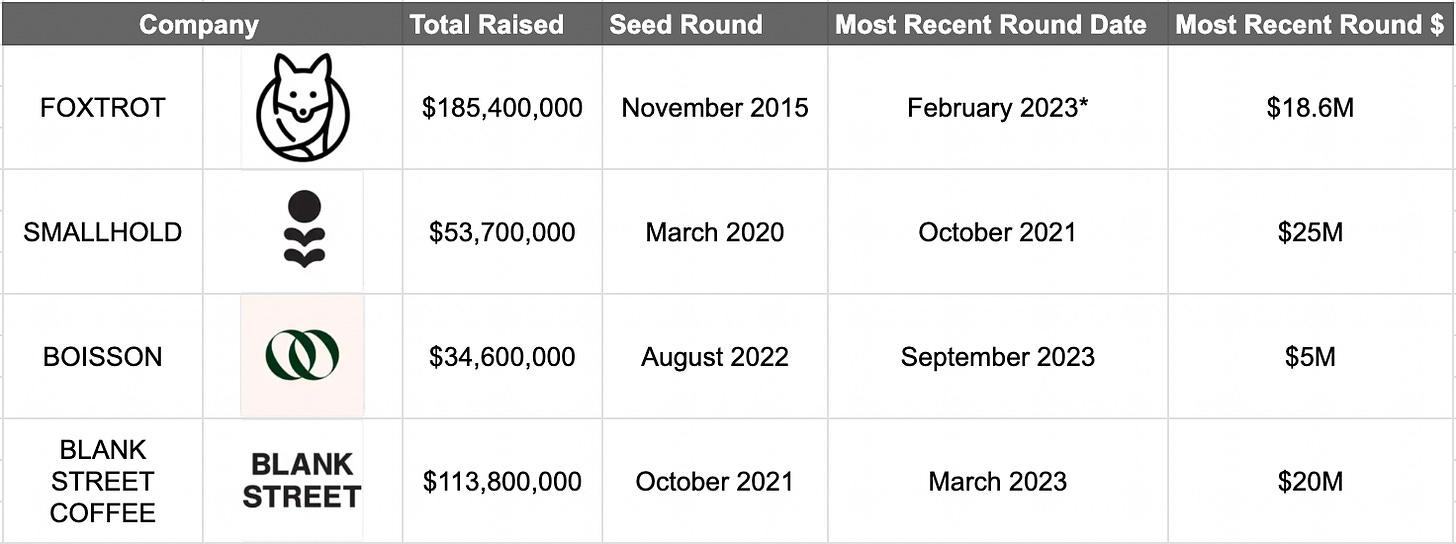

The table below shows the total amount of money raised by each company and when.

Blank Street Coffee has opened 75 locations across NYC, London, Boston, and Washington D.C. in under 4 years. Compare that to the two chains Blank Street is trying to supplant. Starbucks had 17 stores in 1987, 16 years after opening, when Howard Schultz merged it with il Giornale. Dunkin’ Donuts took 15 years to get to 100 locations but likely could not have gone this fast without their franchise model.

Venture fund fueled growth is true for all 4 companies. Boisson, a non-alcoholic bottle shop raced to 9 locations in New York City, Los Angeles, San Francisco and Miami. Smallhold expanded their mushroom farms to California and Texas while launching nationally in over 1000 stores. Foxtrot, the most recent collapse, had gotten to 33 locations of its modernized, design-centric convenience store before shutting down last month.

These were not necessarily bad companies but it’s hard to see how they were ever venture fundable. Mushrooms, non-alc Negronis, potato chips and coffee have little in common with enterprise software or digital content. Atoms don’t scale like bits. Scaling in the physical world with physical stuff is bound by material costs, energy requirements, and the pesky laws of physics. In contrast, the abstract and flexible nature of bits allows digital technologies to scale rapidly with little to no degradation. Foxtrot, Boisson and Smallhold were able to defy gravity only as long the cash allowed them too. Once funders realized the limitations of the physical world didn’t align with their expectations for rate and pace of return, the cash slowed. Rapidly rising interest rates then turned the spigot off completely.

So is Blank Street Coffee next? They closed at least 2 stores in D.C. last month. A Standard article recently noted losses of over $3M in the first 6 months of operations in London. $20M of new funding in March of 2023 was apparently for the launch of a subscription service. This sounds to me like a hail mary bet to convince the world they are actually a Coffee as a Service (CaaS?) digital company in order to keep the party going.

I’m pretty skeptical anyone will be convinced.