Taking Credit

As Credit Card Companies Acquire Reservation Platforms, What's in it for Restaurants? Ask Rihanna.

Audio from Eleven Labs (can be a little wonky)

The history of credit systems and their relationship to food goes back a long time, a very long time. The earliest systems of credit date back to Mesopotamia around 5000 years ago. Credit systems were needed because of the time gap between planting and harvesting crops. Fast forward to the 1800’s and charge coins and plates were commonly used for similar purposes

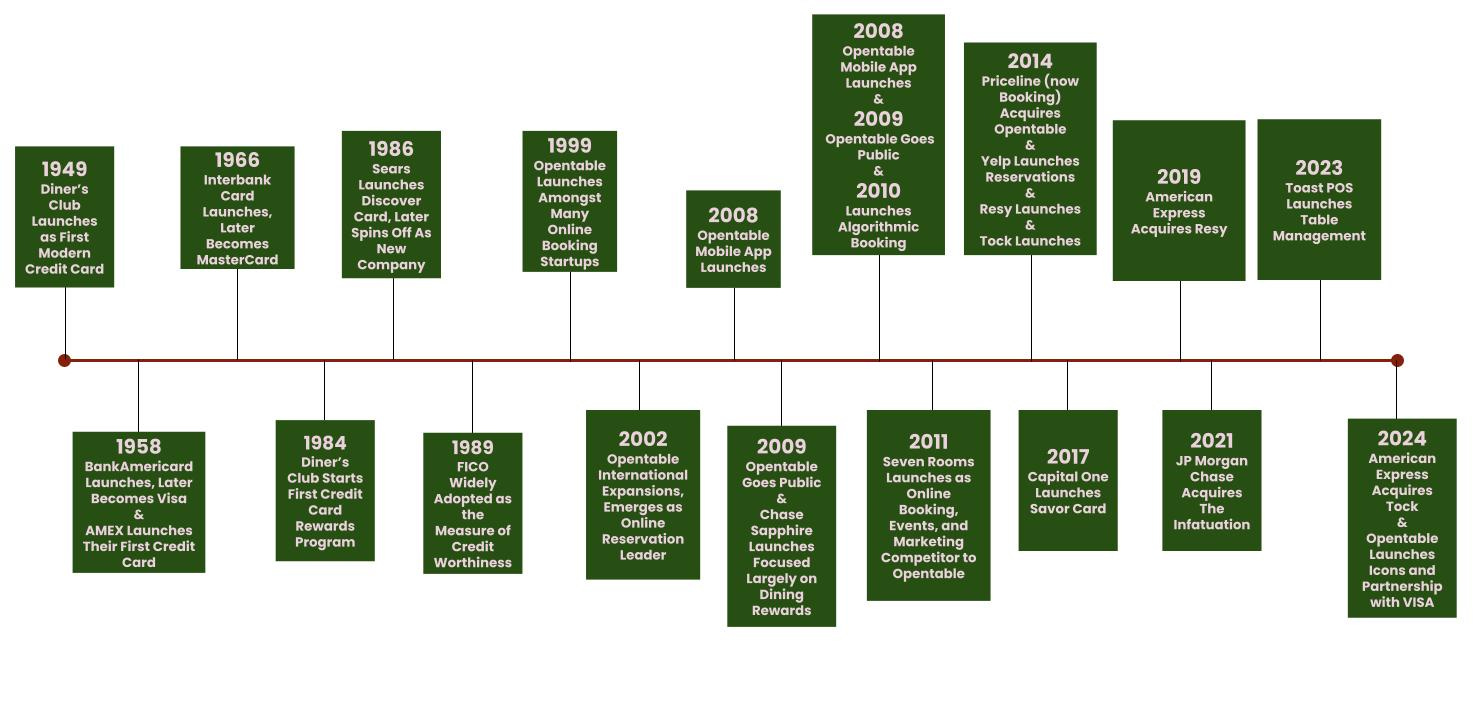

.We ditched our agrarian roots through the 20th century but the connection between credit cards and food is as strong as ever through restaurant spending. A primary goal of this newsletter is to reinforce how important restaurants are in modern society and economics. Credit card companies and their issuers need no convincing of this importance. American Express, Visa, and Chase have been jockeying for position within the industry via reservations and content for the last 10 years, with the last few months being particularly active. Specifically, American Express recently announced the acquisition of Tock for $400 million. Opentable countered with their Visa Dining Collection partnership and Icons program, an explicit effort to win back the most in-demand and influential restaurants from Resy.

Opentable existed as a virtual monopoly in the USA from around 2002 until 2014, the year that they were acquired by Priceline (now Booking). Opentable showed all of the textbook signs of a monopoly- failure to innovate, price gouging, and barriers to entry. In 2014 Resy, Tock, and Yelp Reservations all launched. I asked a couple restaurant tech friends why 2014 was such a year for restaurant reservation tech. Best I can tell, it was a combination of cheap capital, increased venture interest in restaurants, and a perception of weakness with Opentable as the dominant player.

By 2019 Resy had proven a worthy competitor to Opentable. They were small in relative number of restaurants (4,000 vs. 50,000) but had done an exceptional job at converting the high demand, highly influential restaurants in many major cities, especially Manhattan and Brooklyn. At the time of American Express acquisition Chris Cracchiolo, then SVP of Global Loyalty and Benefits, said "We look forward to working with the Resy team to continue to grow the Resy digital platform, and develop new ways to further connect our Card Members and restaurant partners through unique access and experiences."

The connection between restaurant reservations and credit card companies has grown in the 5 years since AMEX acquired Resy for exactly this reason- access and experiences. The chart below from McKinsey shows the extremely divergent trajectories of spending on goods vs. experiences since 1960. AMEX members expensed more than $100 billion dollars from restaurants in 2023, the first time that threshold has been cracked.

And the trend will likely accelerate with younger generations. American Express spoke to spending habits in their 2nd quarter earnings call.

Millennial and Gen Z customers grew their spending 13% and continued to drive our highest billed business within this segment. These younger card members continue to demonstrate strong engagement, and we see that they transact over 25% more, on average, than our older customers. And in some categories like dining, they transact almost twice as much.

As consumers spend more on experiences, and restaurants specifically, credit card companies believe they can win and keep customers with access to restaurants. Reservation platforms are the gatekeepers to that access. But it goes beyond access- the credit card companies want to be directly associated and integrated with the experiences. They are investing in content for restaurant discovery and trends as well as dining events. JP Morgan Chase bought The Infatuation, a restaurant recommendation site, in 2021 on the heels of the incredible success of the Chase Sapphire card with its dining centric rewards. Resy recently launched a very Infatuation-esque discovery tool. American Express has invested heavily in elite dining events like Eleven Madison Park Summer House, Lilia Yurts, and high profile collabs where “…an eligible American Express® Card must be on your Resy profile to unlock.”

What does this all mean for the restaurants themselves?

In a word, I think this means restaurants have more power. Resy and Opentable are the means to the end but it’s access to the restaurants they actually want. When I saw the big Opentable Icons release, I texted some operators who were on the very short lists to ask what came with it. Were there other benefits? I was told not much beyond the press release feature, badge on their Opentable page and generally being in good company. As restaurants, we need to understand our value in this equation and not be such a cheap date. Debby Soo, CEO of Opentable, laid it out clear as day in her interview for the (awesome) restaurant tech newsletter Expedite from Kristen Hawley.

It’s also strategic. The restaurants dubbed OpenTable icons are, per Soo, the type of place that other restaurants want to emulate. “If one of them moves to OpenTable, they’re going to get a call from others asking, ‘Why did you move?’ We know that happens,” she says.

I admire the candor here. They launched this program to use influential restaurants to win others. This, coupled with a more affordable subscription model, is exactly what Resy did in their early days and now Opentable is using the playbook against them. But it’s not clear whether restaurants will benefit from their influence and attention. I have heard rumors (yes, only rumors) that Opentable is offering cash payments to influential restaurants for switching back over. I hope this is true and that eventually every reservation platform has to work, or pay, to win any restaurant.

In the words of Rihanna, arguably our age's most ardent and successful capitalist….Bitch Better Have My Money.