(Audio by Eleven Labs can be wonky)

I wrote in a piece a while back that I believe there will be a Trillion Dollar restaurant tech company and I’ve gotten a few questions since then about who I think it could be. I decided the best way to answer this was with a draft. Before we get started with my picks, a few things to clarify.

You cannot build a $1T company on the back of a $1.4T industry without killing it. Whoever gets there, they will have to unlock new revenue and value for and from the industry- that FOR part is really important.

I believe this revenue will come from a combination of monetizing attention & advertising, data & training AI models, addressing societal issues like loneliness and disconnection, vertical AI agents marketplaces, hardware & software.

Some of my draft picks are not formally tech companies but, in a way, every big company is a tech company. Technology will be the backbone to creating and capturing new value in an industry as fragmented as restaurants.

The rule was creating $1T in market cap value mostly from the restaurant industry.

Ok, here we go. With my first pick in the draft I select…

#1 Doordash

To be clear, I don’t want this to be true and think it would be very bad for restaurants. That said, when making draft picks the idea is to WIN. Doordash, since it’s inception, has combined a real understanding of the role restaurants play in modern culture and utter shamelessness to become, far and away, the market leader.

Network Effect Dominance: Controls nearly 70% of the food delivery market, creating an unmatched logistics network with the highest density of drivers and restaurant partners that becomes more valuable with each additional participant.

Data Advantage: Possesses the richest dataset on consumer food preferences and ordering patterns in the industry, enabling them to develop proprietary insights that could power everything from ghost kitchen concepts to personalized food recommendations.

Platform Expansion Potential: Enormous expansion potential internationally, in advertising and further into hardware and software.

#2 American Express

AMEX, like Doordash, is one of the only companies that really get’s how important restaurants are. Restaurant spending with AMEX topped $100B annually on 2023 for the first time. To get to $1T they’ll need to find a way to capture a broader representation of the industry than their historical higher end leanings.

High-Value Customer Capture: Has secured relationships with the most affluent diners through Resy and Tock acquisitions, controlling access to the highest-spending segment of restaurant consumers.

Closed-Loop Data System: Uniquely able to see both consumer spending patterns and restaurant operational data, creating unmatched visibility across the industry ecosystem.

Experience Monetization: Perfectly positioned to capitalize on the shift from material goods to experiences, with dining representing the most frequent high-value experience consumers pursue.

#3 Louis Vuitton Moet-Hennesey

I write a lot about LVMH, I know. That’s because they’re ahead of the curve on the transition of spending from goods to service and throwing a lot of weight and money around in experiences, especially hospitality. Like AMEX they have to find a way ‘down market’ but if Sephora, an LVMH brand, is any indication then they’ll figure that out.

Vertical Integration Strategy: Already acquiring iconic restaurants (L'Ami Louis in Paris) and potentially looking to create an "LVMH of hospitality" similar to their luxury goods portfolio.

Global Luxury Consumer Base: Commands loyalty from the world's highest-spending consumers who view dining as an extension of their luxury lifestyle, connecting fashion, travel, and culinary experiences.

Hospitality as Brand Extension: Can leverage restaurants as physical manifestations of their brand values and touchpoints for their broader luxury ecosystem, creating synergies across their portfolio.

#4 NewCo.AI

This company either does not yet exist or is pretty early stage. Existing players in restaurant tech may have a distribution advantage but they are not built on AI foundations. This will create a lot of technological debt for companies like Toast, Square, Doordash, etc. These companies will also have to deal with the innovators dilemma while also navigating the relentless pressure of quarterly public company scrutiny which does not favor long term thinking if it comes at the expense of near term performance. All of this means that a start-up may be best positioned to rethink the entire Restaurant tech stack on top of AI rails.

Natively Built for AI: There’s an opportunity to build a complete tech stack for restaurants with the sophisticated operating and financial systems heretofore unavailable to all but the biggest players in the restaurant industry.

Nimble and Unencumbered by Public Markets and Entrenched Technologies: It feels like very good time to to be the anonymous, lean upstart without any tech debt or large headcount.

Aligning Interests and Revenue with AI tools: I tell any restaurant tech company who asks (plus those that don’t) that the best path forward is to build tools for restaurants to help themselves and their fellow operators. Basically the App Store and Software Developer Kit for the industry. Basically the Cursor, Replit or Lovable specific for restaurants.

#5 Toast

120,000+ restaurants in the US and a ton of room to run internationally. Like Doordash, they’re also highly focused on the restaurant industry though a recent foray into retail feels like a distraction to us restaurant people (see relentless public market pressure above). That said, they get restaurants and have a very effective ground game in sales. They’ll need to find a compelling consumer facing element to get to $1T. Reliance on B to B SaaS and commodity payments won’t get there.

Operational System of Record: Already serves as the technological backbone for hundreds of thousands of restaurants, giving them unparalleled access to operational data across the industry.

Multiple Monetization Opportunities: They can be the real estate game helping place restaurants with landlords, sell data to CPG giants a la Scintilla/Walmart, and delve further into financial services. I’d also love to see them backwards integrate into vertical GPUs to power industry specific hardware. Nvidia sees the opportuntity.

THE Full-Stack Solution: Building an end-to-end platform that connects every aspect of restaurant operations from inventory to customer relationships, creating high switching costs and ecosystem lock-in.

#6 UBER

They should really be #1 or #2 but they’re getting beat badly by Doordash. Between Ubereats and transporting people to and from restaurants, dining & food has to have at least a plurality of their business. They are everywhere, just like restaurants but likely need to partner with others o this list (or elsewhere) to make up ground on Doordash.

Global Market Reach: Operates in over 10,000 cities worldwide, creating unmatched distribution potential for restaurant concepts across diverse markets.

Multi-Modal Movement: Controls both the movement of people to restaurants and food from restaurants, positioning them at both ends of the dining experience.

Membership Stickiness: Uber One subscription creates a closed loop that encourages consumers to stay within their ecosystem for all transportation and food needs, driving higher frequency and retention.

#7 Square (BLOCK)

I don’t think they get there trying to beat Toast at the POS game. For me Square’s advantage is the positioning as a more open, blockchain platform. Web 3 & Blockchain have had a rough couple years but I believe it will reemerge with a stronger focus on restaurants. The industry is in desperate need of ways to cooperate and disintermediate and that’s what blockchains can do, if the technology becomes user friendly enough, fast enough. Big IF.

Financial Ecosystem: Has built a complete financial services stack for small businesses that could expand to include specialized restaurant financing, insurance, and capital allocation tools.

Multi-Vertical Integration: Ability to connect restaurants with retail, service businesses, and other local commerce through their broader payments ecosystem.

Consumer-Merchant Connection: Cash App's consumer reach combined with their merchant services creates a powerful closed loop system for discovery, payments, and loyalty.

Kobe Bryant was the 13th pick in the draft. Nikola Jokic was 41st Joe Montana was 81st. Tom Brady was famously 199th, dead last. My last 3 picks are in that spirit.

#8 Sweetgreen

It won’t be the salad that brings Sweetgreen to Mag 7/FAANG level heights. The stars would need to align around their robotics and automation as well personalized nutrition and health care. I think they’d also need to have 1-2 more unique, aligned restaurants brands under the umbrella. They tried before to convince the world they are a tech company, not a food company. They’re starting to look more like a tech company to me.

Digital-First Optimization: Has built a scalable, data-optimized food production system that could be applied across multiple concepts and price points.

Health-Focused Platform: Positioned at the intersection of food and wellness as health-consciousness continues to grow, with potential to expand into personalized nutrition and health outcomes.

Supply Chain & Automation: Pioneering direct relationships with farmers and vertical integration in the supply chain, potentially transforming how restaurants source ingredients.

#9 Wonder

This is a really wild company. They pivot from cooking food in vans to brick and mortar. They buy Blue Apron. They buy Grubhub. The play to lock up ‘content’ (food, chefs, concepts) by treating food as intellectual content aligns their interests with the restaurant in a way I think many operators will find compelling. Anyone who says they know what this company is doing next is probably wrong, including me.

Multi-Brand Portfolio Strategy: Building a diversified portfolio of restaurant concepts that can be deployed across multiple formats from delivery-only to brick-and-mortar locations.

Technology-Enabled Food Production: Developing systems to maintain quality and consistency across concepts while enabling efficient scaling through centralized production.

End-to-End Control: From acquiring Blue Apron and Relay to building their own storefronts, they're creating a fully integrated food platform that controls every aspect of the customer experience.

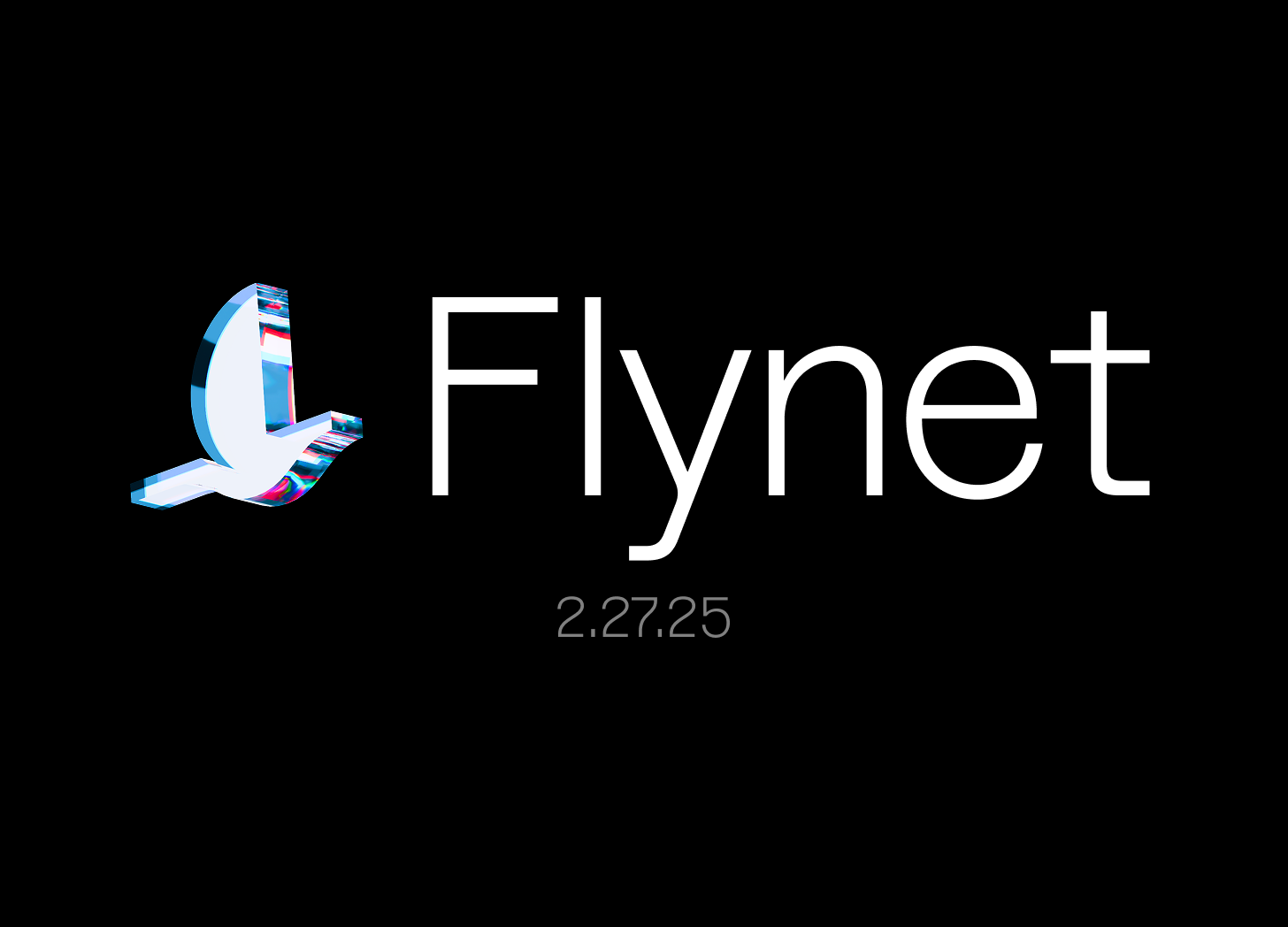

#10 Blackbird

Ben Leventhal has been all in on restaurants for 20 years and few have influence the industry more over that time. From one vantage point, Blackbird is just another loyalty meets payments play. I think there’s something WAY more revolutionary happening here. Blockchain and crypto technologies are made for highly fragmented, decentralized contexts like restaurants. Blackbird recently announced Flynet, calling it a ‘new set of financial rails’ that ‘unlocks a whole new economy’. A touch hyperbolic, sure. But creating an entirely new blockchain based economy exclusively for restaurants feels like a BIG idea to me. I am rooting for them.

Community Currency Innovation: Creating a restaurant-specific currency ($FLY) that could evolve into the dominant loyalty and payment system across the industry.

Direct Consumer Relationships: Building direct connections between restaurants and diners without extractive middlemen, preserving more value within the restaurant ecosystem.

Founder-Market Fit: Led by Ben Leventhal who has repeatedly reshaped the industry with Eater and Resy, bringing deep industry relationships and proven vision for where restaurants are headed.

Just like draft day, predicting which company will reach trillion-dollar status in restaurant tech requires equal parts analysis, intuition, and luck. Some of these picks will exceed all expectations and become the Tom Brady of the industry, while others might join the long list of promising prospects who never quite lived up to the hype. Regardless of how this draft class performs, one thing remains certain—the company that ultimately creates and captures a trillion dollars of value will be the one that recognizes restaurants aren't just places that need technology, but powerful platforms that deserve to share in the wealth they help create.