Let’s start on a high note. I do not believe anything I’ve written here is inevitable. Every company, restaurant, landlord, guest, etc has agency and choice. My favorite Danny Meyer-ism is the charitable assumption, the choice to grant the benefit of the doubt and assume the best in people. My charitable assumption is that guests are smart and care about their neighborhoods and communities. Guest’s also know, if maybe only subconsciously, that viable and dynamic restaurants are an important part of the societal fabric.

We are all guests.

I settled on 3 main causes for my pessimism. They are intertwined and compound on each other making them particularly thorny. Alright, down the rabbit hole…

The Tragedy of the Commons

For a couple hundred years, the restaurant ecosystem was generally symbiotic. Restaurants, suppliers, service providers, landlords, and other stakeholders understood that they were part of an ecosystem wherein the collective interest was jeopardized by any one stakeholder trying to extract too much value, that’s the Tragedy of the Commons part. The symbiosis (with an unfortunate dash of lax regulation and exploitative labor practices) could lead to sustainable profitability. Nothing huge but enough to make the juice worth the squeeze for an independent operator doing the hard work of running their restaurant.

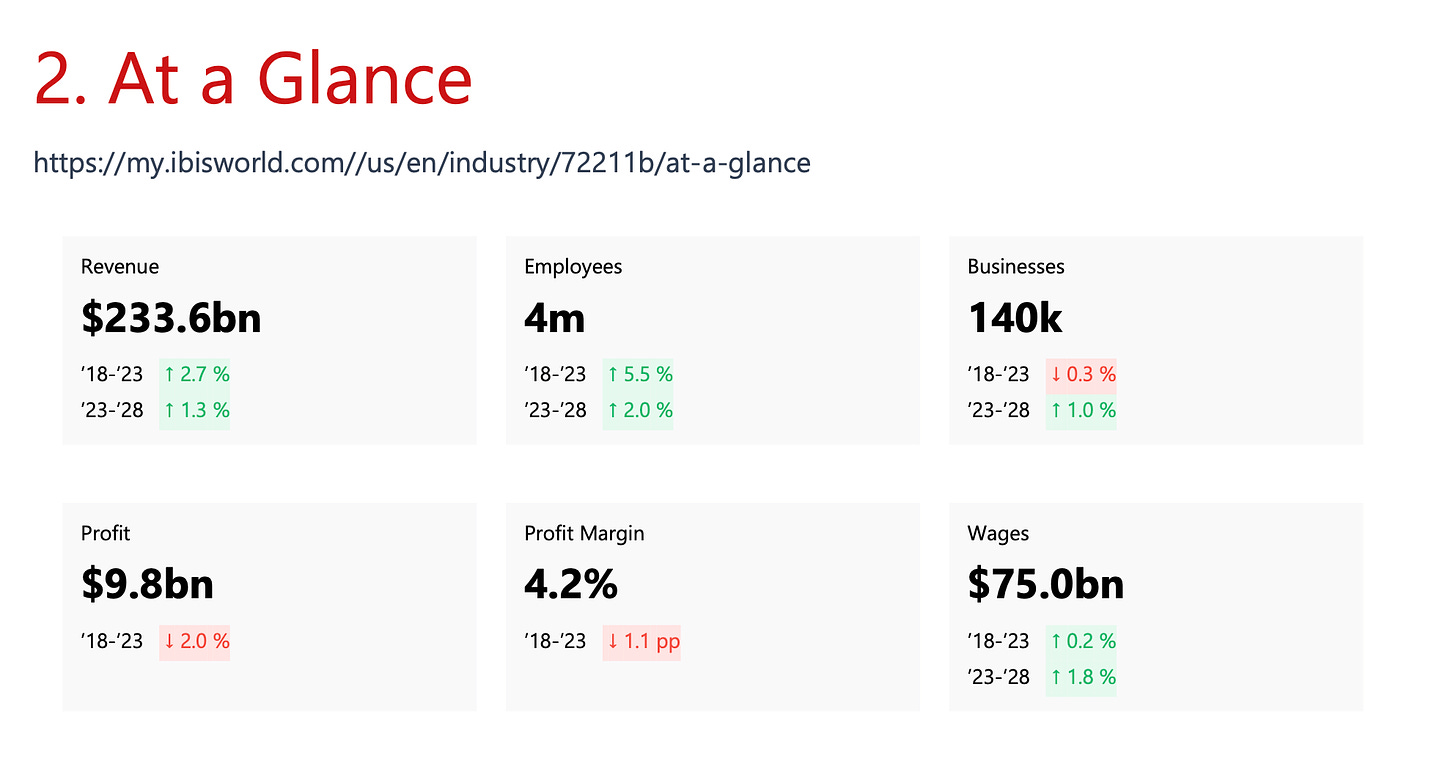

This changed in the last 20 years. Restaurants are now being mined by a new generation of companies driven by Average Revenue per User (ARPU) and SaaS unit economics like Lifetime Value (LTV). The problem is that a tech companies ARPU and LTV are often a restaurants’ profit. Of course the promise is that using product X will deliver efficiency/revenue/savings far in excess of the cost of product X. But if this promise was legit, restaurant profitability wouldn’t be shrinking as these products and services proliferate. As the above image show’s profits are down 20% since 2018. My own experience has been that 12% EBITDA was achievable with good wages and product as recently as around 2015 but is now unattainable on a regular basis. Are the tech products the sole reason for this decline, no…but they are undoubtably part of the problem.

Who are we talking about? It’s many tech companies, but those in the revenue share and pay-to-play ad games are the worst offenders. Uber and Doordash take revenue shares between 15%-30% and are now pushing advertising hard. Opentable has subscription, cover fees, and is also hot on advertising. Indeed preys on a restaurant hiring needs with sponsored ads, replacing what was a $30 Craigslist ad in 2010 with an average daily budget of $30. Their stock price is up 5x since 2016 while the S&P 500 is up 2x over the same period. Pure SaaS + payments players like Toast and Square also draw from profitability though their ARPU play is in aggregating the restaurant tech stack. I’d also say that as an operator, Toast and Square seem to understand they are a partner in an ecosystem, not an invasive species. Alas, the market seems less inclined to reward this. The Toast stock price closed around $23 this week after popping to nearly $60 at IPO.

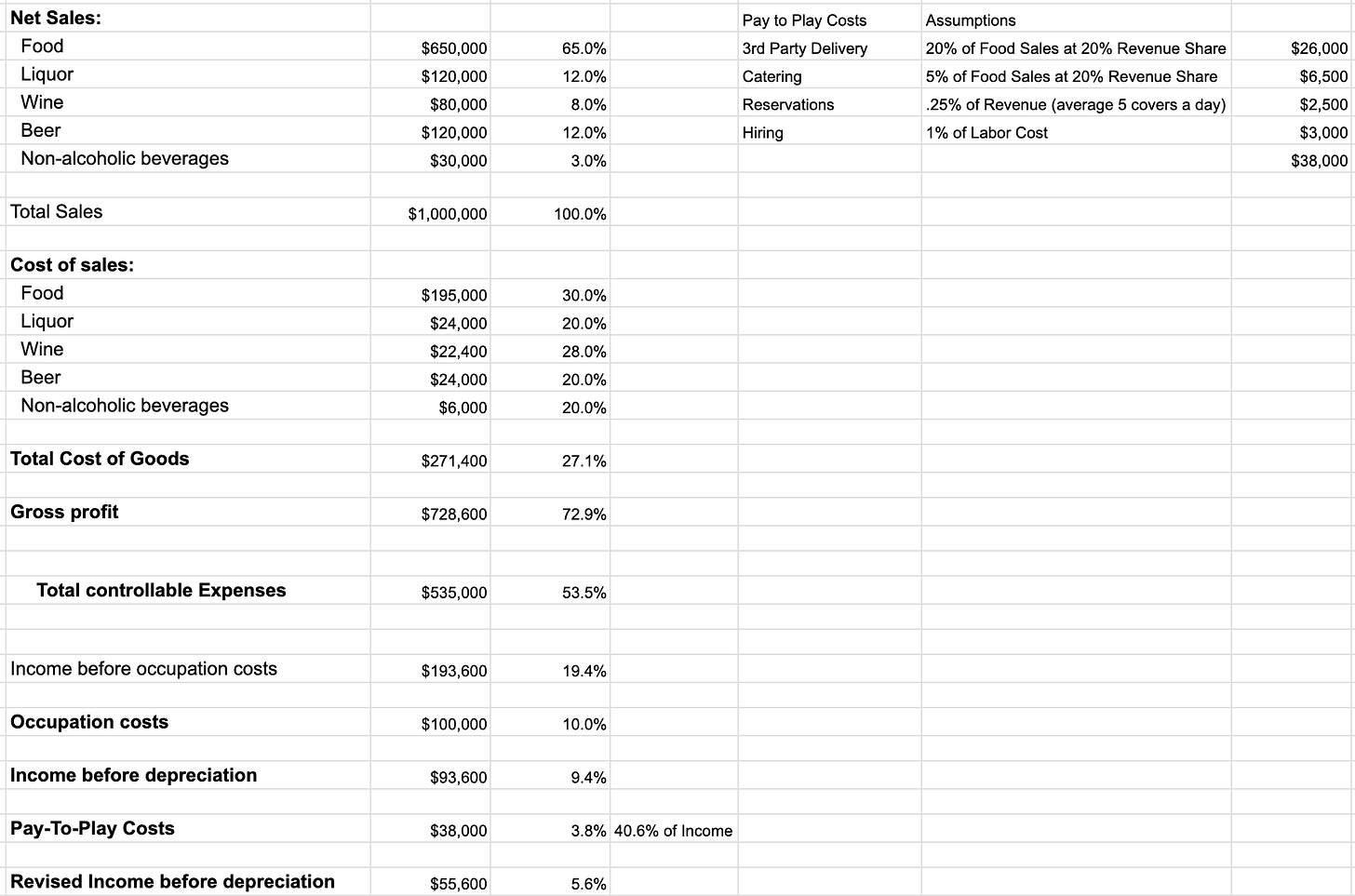

The spreadsheet below shows the impact of the pay-to-play & ad players on a $1M sample restaurant P&L. The $38,000 in costs between revenue shares and advertising equates to 40.6% of the restaurants income before depreciation. I’m willing to grant that a portion of the revenue is truly new and therefore additive but the analysis at our own restaurants leads me to believe it’s less than 50% from Doordash, Ubereats, and Opentable.

Winner Take Most

This is an economy wide problem in the United States that the restaurant industry has been slower to succumb to. The industry is historically pretty long tail heavy. The NRA estimates that about 70% of restaurants in the US are single location independents. There are couple trends that could lead to a further proliferation of chains at the expense of independents.

There is evidence of a trend toward chains going back over a decade. The NPD Group, now Circana, noted in 2012 that 87% of visit losses over the previous 3 years were from independent restaurants. In 2018 they noted a 4% increase in fast casual chain locations against a 3% decline in independents. Analysts also began predicting in 2020 that COVID related closures of independents would also lead to more chains taking over the spaces.

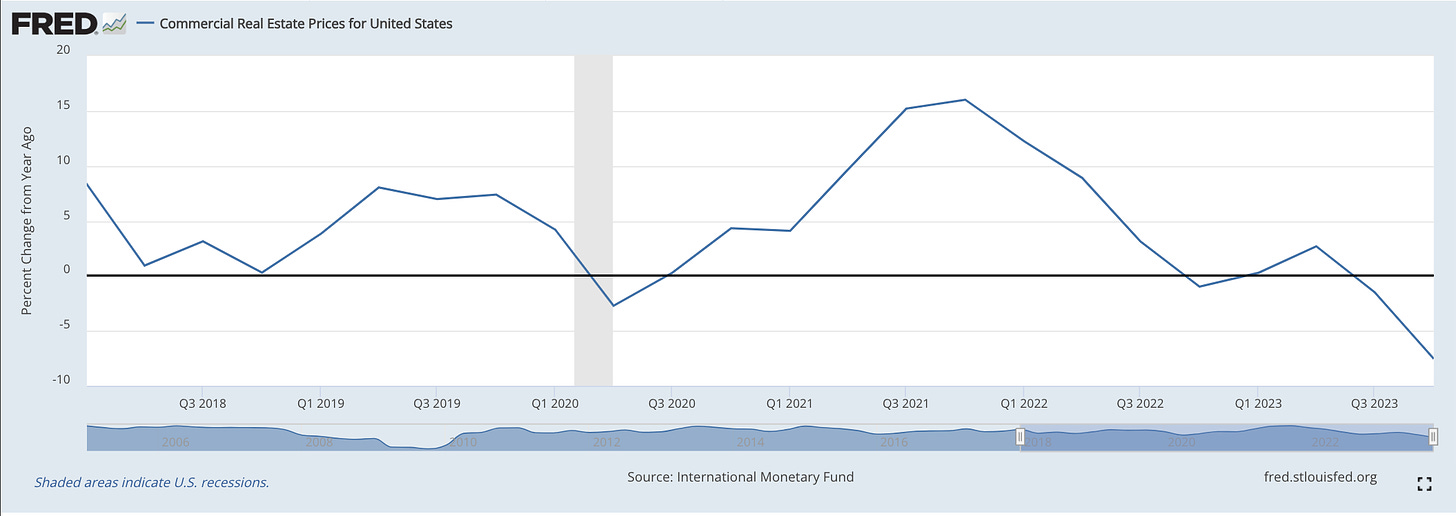

There is limited good real estate for restaurants. Well capitalized chains have an edge in assessing this real estate and always have. They can better assess the viability of the real estate and can pay higher base rent costs. The difference now is that the landlords and developers may be more inclined to go for the top dollar per square foot given the potential decline in commercial real estate values stemming from the remote work fallout. Upper floor office rents often subsidize ‘amenity’ ground floor retail like restaurants. If landlords can’t count on that higher rent upstairs, they’ll take it elsewhere.

I am also concerned that most of the benefits of AI will accrue to chain restaurants. I do believe that AI is going to create a lot of efficiencies in restaurants through both optimization and automation. I am less certain that the tools of AI and the expertise to apply them will be affordable enough for the average independent restaurant to leverage. Restaurants, especially chains, sit on mountains of data ripe for machine learning but I fear the cost to effectively analyze it deliver insight and action will make it purely a tool of large chains.

If my most pessimistic self is right, I don’t think the outcome is less restaurants. The rise of e-commerce has made the increase in restaurants inevitable. The more likely result of winner take most will be homogenization of the industry and the further proliferation of chains.

Fear the Mechanical Turk

I recently stopped into Kernel in NYC. Kernel is a new plant based fast food concept from Steve Els, the founder of Chipotle. There were two people working inside a box of lockers with a robotic arm off to the side doing much of the cooking. At least that was the idea because the entire operating system was down so they couldn’t do any hot food at all.

I also stopped by the Wonder location in Chelsea where there were menus from at least 10 different restaurants being offered. All of the food is made in a commissary and brought to the location to be reheated on order. There was one person working the counter and perhaps another 2-3 hidden away in a “kitchen”, in quotes as there was nothing to indicate a kitchen in a traditional sense, no hood sounds, clanking pans, dish machine, etc

The Mechanical Turk was an 18th-century automaton, presented as a chess-playing machine operated by gears and levers, but it secretly housed a human chess master who controlled its movements. In modern times, the idea of the Mechanical Turk has often been discussed as a metaphor for systems where human labor is hidden behind the facade of automated technology.

Kernel, Wonder, and Sweetgreen’s Infinite Kitchen all speak to the future of robotics and automations in restaurants. The story the leaders of those companies tell is that they are going to free up the people from the tedious work to engage more in the human-centric hospitality of foodservice. In fairness, the two managers(?) I interacted with at Kernel were great. They were excited about the concept and went above and beyond when they couldn’t cook anything. That said, enclosing 2 workers inside a box of cubbies to do final food assembly with little potential for eye contact or interaction beyond putting the food in cubby from their side of the cubby does not feel like elevating humans to what they do best while robots do the dirty work. What it does feel like is an attempt at a waypoint until the people can be fully automated away.

Dash Vader

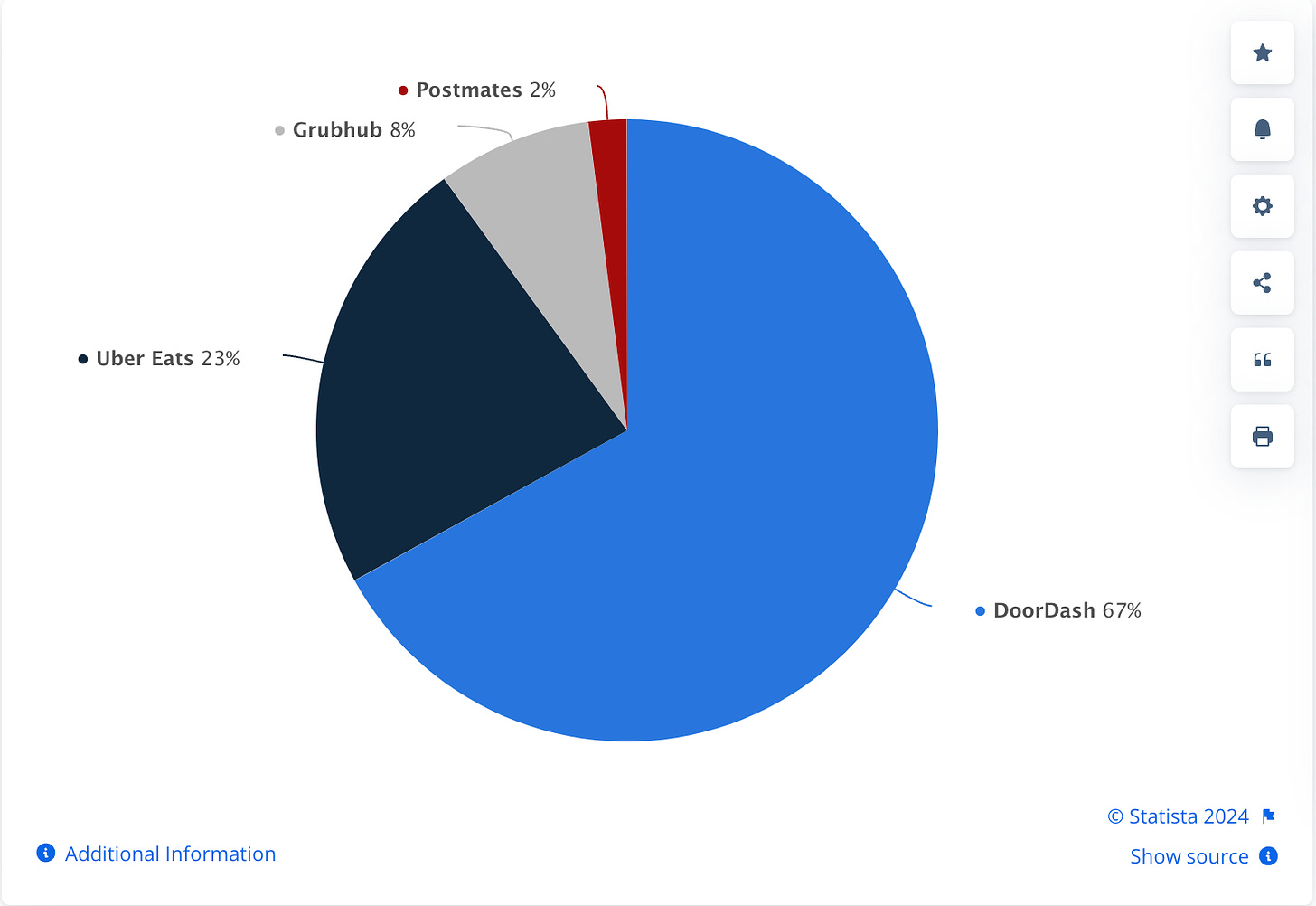

Doordash worries me most as the symbol of a dystopian restaurant future as I think they’re the best positioned to compound the ‘winner take most’ + ‘mechanical turk-ification’ and are the most invasive species in the ecosystem. To illustrate this, think of Doordash as a landlord in a city where they own nearly 70% of the apartment building and condos.

Their marketshare gives them incredibly pricing power. Everyone has to live somewhere so any one tenant doesn’t matter in the least to Doordash because when one tenant leaves, another one will come in and they will get their rent. Doordash is thinking of ARPU and LTV at an industry scale. To Doordash, a restaurant is nothing but a cash generating node on a logistics network. Don’t take my word for it, this is a quote from Doordash CEO Tony Xu in his last earnings call

…we always thought that we had an advantage given just our Dasher density and the network that we've built up where the thesis would go, if you can build the largest network in the highest frequency category, in the category that has the most nodes for last mile delivery, i.e., there are more restaurants than there are any other category of local retail…

Their data, access to capital, and technological expertise will also allow them to take full advantage of automation that will make the delivery logistics portion of their business cheaper while they extract ever higher rent from restaurants.

I firmly believe a $1 Trillion+ technology company will be built on top of restaurant and hope dearly that it is not Doordash.

Last week I wrote the optimistic version of this piece and realize in writing the pessimistic take that many of our gravest threats derived from the same places as our opporunities. For example, Xu’s reference to restaurants as nodes on a giant network is a Sith lords take on the centrality of restaurants to modern life. The democratizing power of AI is as likely to accrue to giant corporations as it is unlock opportunity for independent operators. It does feel like the industry is at a crossroads shaped by technological advances, economic pressures, and profound shifts in societal norms. The pessimistic outlook underscores the threats posed by technology's encroachment on profit margins and the growing dominance of large chains. The optimistic perspective eagerly anticipates what highly adaptable and creative operators will do with additional tools and potential impact on their communities. These conflicting visions are two sides of the same coin, highlighting the challenges and opportunities that lie ahead. Which side of that coin we land on lives mostly in the hands of guests and consumers.

To end on a high note, I recently saw in Morning Consult research that Gen Z is the generation most open to trying new restaurants. This is reassuring.

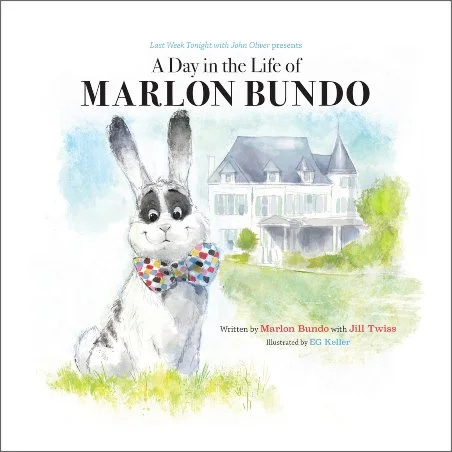

I read Marlon Bundo to my 2 1/2 year old daughter almost every night. For those who don’t know it, Marlon is the gay bunny of the Mike Pence family. He falls in love with Wesley but The Stink Bug, a Pence-looking insect, tells them they can’t get married because boy bunnies marry girl bunnies. Everyone is distraught until Mr. Paws, who is a very good and very smart dog, says ‘Wait a minute! We get to decide who is In Charge. We get to decide who is Important!”

Yes, we do and we are all guests.